Are Copier Leases Included In Gasb 87. The university should apply the same principles to any. Web what is gasb 87 and how does gasb define a lease? A university has a copier lease allowing for use of any copiers over the period of the lease. What are the effective dates for gasb 87? Web a lessor should recognize a lease receivable and a deferred inflow of resources at the commencement of the lease term, with. 87, leases, or gasb 87, is a statement that outlines new requirements for lease accounting for governmental entities. Web gasb 87 is the new lease accounting standard issued by the governmental accounting standards board, gasb. What is considered a nonfinancial asset? Web gasb 87 is applicable for fiscal years beginning after june 15, 2021. What is the difference between capital and operating. Copyright © 2024 by financial accounting foundation. This new standard supersedes gasb 13 and.

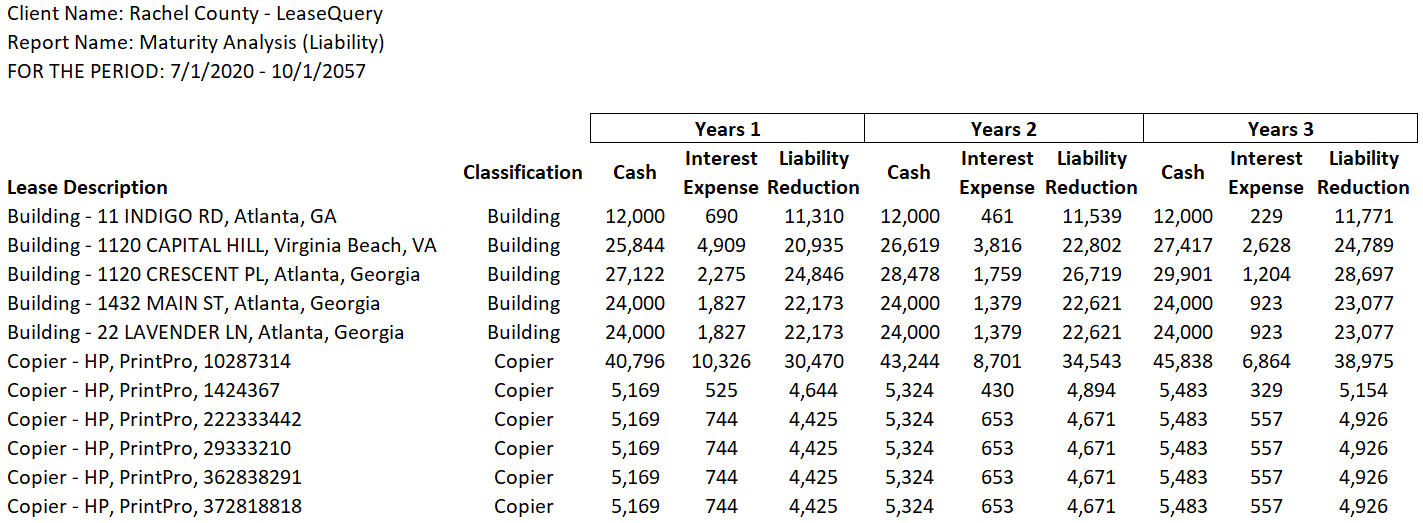

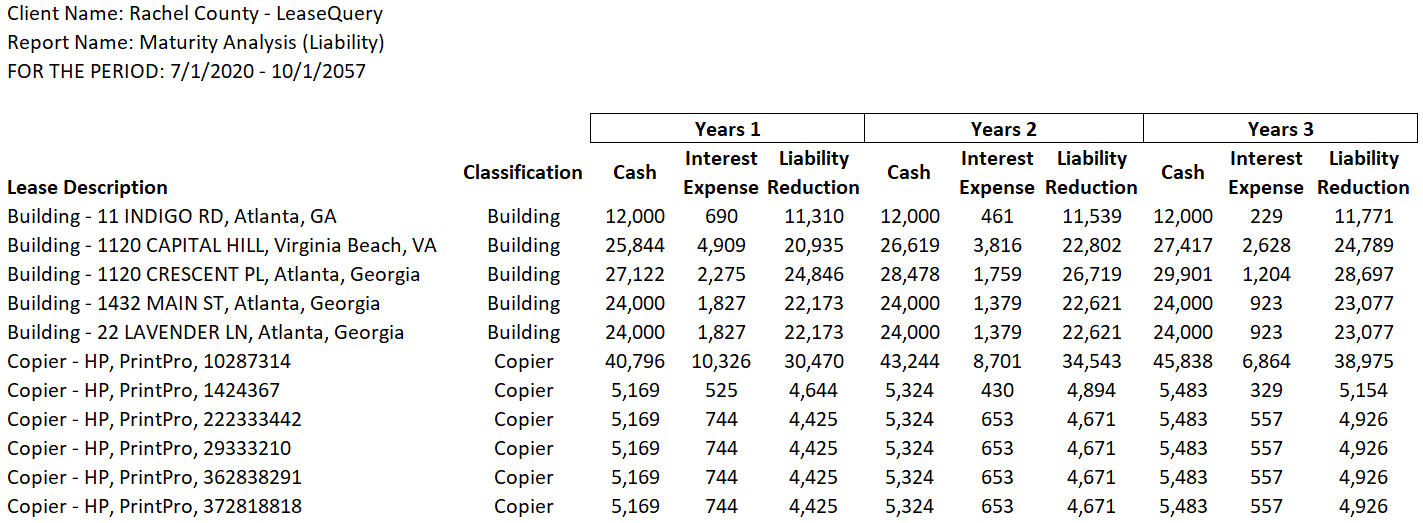

from leasequery.com

Copyright © 2024 by financial accounting foundation. What is considered a nonfinancial asset? Web a lessor should recognize a lease receivable and a deferred inflow of resources at the commencement of the lease term, with. Web gasb 87 is applicable for fiscal years beginning after june 15, 2021. The university should apply the same principles to any. What are the effective dates for gasb 87? This new standard supersedes gasb 13 and. Web gasb 87 is the new lease accounting standard issued by the governmental accounting standards board, gasb. A university has a copier lease allowing for use of any copiers over the period of the lease. What is the difference between capital and operating.

GASB 87 Disclosure Requirements for Lessees Explained + Examples

Are Copier Leases Included In Gasb 87 The university should apply the same principles to any. Web gasb 87 is applicable for fiscal years beginning after june 15, 2021. Web a lessor should recognize a lease receivable and a deferred inflow of resources at the commencement of the lease term, with. What is considered a nonfinancial asset? 87, leases, or gasb 87, is a statement that outlines new requirements for lease accounting for governmental entities. Web what is gasb 87 and how does gasb define a lease? This new standard supersedes gasb 13 and. A university has a copier lease allowing for use of any copiers over the period of the lease. What are the effective dates for gasb 87? Web gasb 87 is the new lease accounting standard issued by the governmental accounting standards board, gasb. Copyright © 2024 by financial accounting foundation. The university should apply the same principles to any. What is the difference between capital and operating.